ev charger tax credit 2022

Latest on Tesla EV Tax Credit March 2022 The Clean Energy Act for America would have a positive impact on Tesla by making most Tesla cars eligible for an 8000 House version or 10000 Senate version refundable tax credit and handicapping Chinese EVs from entering the US market. A rather significant federal tax benefit is available to most taxpayers who recently installed electric vehicle charging stations and it seemingly is a feature that flew under the radar for many.

Rebates And Tax Credits For Electric Vehicle Charging Stations Electric Cars Electric Car Charging Electric Vehicle Charging

Another 500 is added for a US-made.

. For residential installations the IRS caps the tax credit at 1000. Congress recently passed a retroactive federal tax credit for those who purchased environmentally responsible transportation including costs for EV charging infrastructure. By Andrew Smith February 11 2022.

Soon after West Virginia Senator Joe Manchin. Consumers who purchase qualified residential charging equipment prior to December 31 2021 may receive a tax credit of 30 of the cost up to 1000. EV Charging Equipment Federal Tax Credit up to 1000.

Permitting and inspection fees are not included in covered expenses. Co-authored by Stan Rose. So now you should know if your vehicle does in fact qualify for a federal tax credit and.

The federal tax credit was extended through December 31 2021. After reading the following overview learn more by contacting Pohanka Automotive Group. The credit amount will vary based on the capacity of the battery used to power the vehicle.

SUBJECT Electric Vehicle Charging Station Tax Credit SUMMARY This bill under the Personal Income Tax Law PITL and the Corporation Tax Law CTL would allow a credit equal to 40 percent of the costs paid or incurred by the owners or. The federal tax credit covers 30 of an EV charging station necessary equipment and installation costs. Another 4500 is available if an automaker makes the EV in the US with a union workforce.

This incentive covers 30 of the cost with a maximum credit of up to 1000. On the cost side. The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles.

Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to. Furthermore Future Energy expects federal tax incentives to be quite robust in 2022. Latest on Tesla EV Tax Credit March 2022 The Clean Energy Act for America would have a positive impact on Tesla by making most Tesla cars eligible for an 8000 House version or 10000 Senate version refundable tax credit and handicapping Chinese EVs from entering the US market.

Information specific to your state can be found on the US. Additional incentive programs for public airports and school districts as well as non-profits and other community support organizations are available as well as a variety of state and federal tax credits and sales tax exemptions. In President Bidens State of the Union address the President voiced support for revisiting EV tax credits in 2022.

You might have heard that the federal tax credit for EV charging stations was reintroduced recently. The federal government offers a tax credit for EV charger hardware and EV charger installation costs. The new tax credit starts with a base amount of 4000 as it is today with another 3500 available if the vehicles battery pack includes at least 40 kwh of capacity for cars placed in service before 2027.

Similar tax breaks have expired and been extended in recent years and in its current form it applies to property placed. It Pay to Plug In provides grants to offset the cost of purchasing and installing electric vehicle charging stations. Residential installation can receive a credit of up to 1000.

Since installation costs are significant for EV chargers this rule allows you to get the most tax credit for your. However Tesla does not employ unionized labor so Tesla would be. 2 days agoWe want to have a million electric vehicles on the road by 2030 and we are attacking that from all ends Mitchell says.

Unlike some other tax credits this program covers both EV charger hardware AND installation costs. The EV tax credit remains at 7500 for all electric models except those made by Tesla and General Motors. Federal income tax credit of up to 7500 for eligible all-electric and plug-in hybrid cars purchased new in or after 2010.

The tax credit covers 30 of a companys costs. It covers 30 of the costs with a maximum 1000 credit for residents and 30000 federal tax credit for commercial installs. Heres how to claim your credit for 30 of the cost of your home charger and installation up to 1000.

The credit ranges between 2500 and 7500 depending on the capacity of the battery. The credit begins to phase out for a manufacturer when that manufacturer sells 200000 qualified vehicles. Were providing a 4000 incentive for consumers to go out and buy an electric vehicle.

2022 EV Tax Credits in Virginia Electric vehicles are energy efficient and affordable but another thing that makes them alluring is the fact that they often come with tax credits in Virginia. For example new EV purchasers may qualify for up to 750 in state tax credits in California in 2022 under the California Clean Fuel Reward program. Residential EV Charging Equipment Incentive Program A Level 1 120-volt charger is supplied with most new EVs.

The tax credit is retroactive and you can apply for installations made from as far back as 2017. Department of Energys Federal and. President Bidens EV tax credit builds on top of the existing federal EV incentive.

Several months later it seems that revisions to the credit are returning to lawmaker agendas. As of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations. Jan 13 2022.

You may be eligible for a credit under section 30D g if you purchased a 2- or 3-wheeled vehicle that draws energy from a battery with at least 25. Currently the federal government offers a tax credit for both EV charger hardware and for installation costs. The tax credit now expires on December 31 2021.

Updated 342022 Latest changes are in bold Other tax credits available for electric vehicle owners. Combined with federal tax credits that can lower the price of an electric vehicle by more than 10000. What Is the New Federal EV Tax Credit for 2022.

So if you recently installed a home EV charging station or completed a large-scale EV infrastructure project you might still be eligible for this. Companies can receive up to 30000 in federal tax credit for commercial installations. If so we have great news for you.

Delta Ev Charger 30 Amp 18ft Rfid Networked Charging Station

Request Ev Charging In Apartment Condo Buildings Bc Hydro

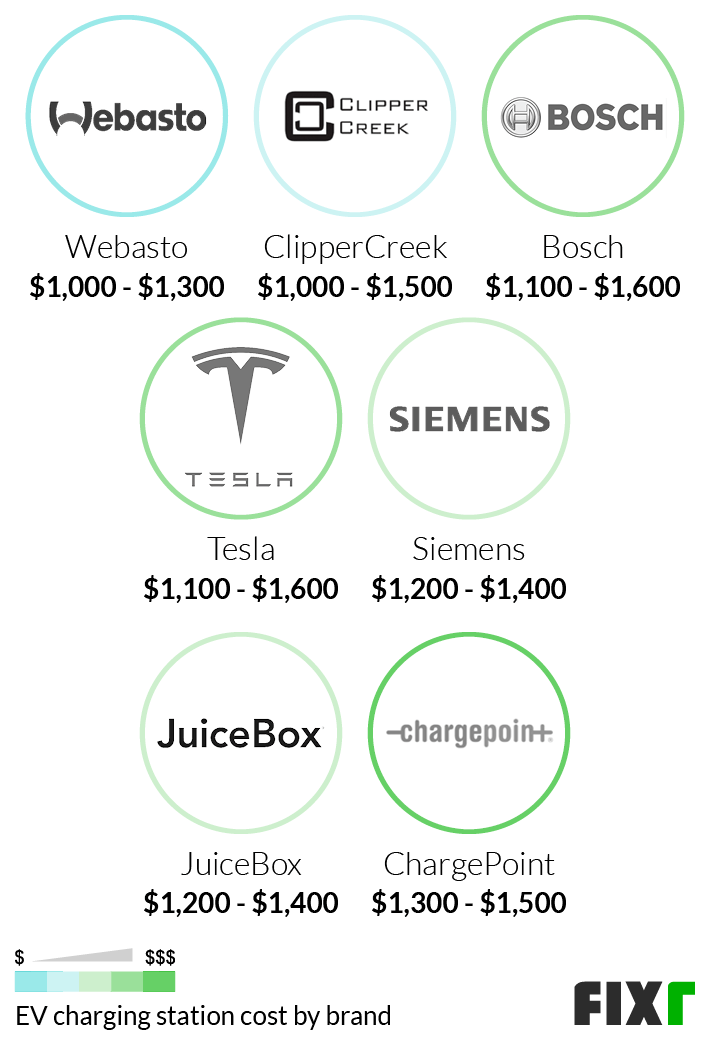

2022 Ev Charging Stations Cost Install Level 2 Or Tesla

Ev Charging Stations 101 Wright Hennepin

Rebates And Tax Credits For Electric Vehicle Charging Stations

2022 Cost To Install Ev Charger At Home Electric Car Charging Station Cost

2022 Ev Charging Stations Cost Install Level 2 Or Tesla

10 Must Read Ev Charger Installations Faq Home Ev Charger Install Sun Electrical In Calgary

Tax Credit For Electric Vehicle Chargers Enel X

Tax Tips For Going Green In 2022 Electric Vehicle Charging Business Advisor Go Green

How Much Do Ev Charging Stations Cost Expect 6 000 On Average

How An Electric Vehicle Can Help You Meet Your Goals In 2022 Life Enhancement Training Fuel Cost Budget Conscious Ev Charging Stations

Ebay Tesla Gen1 80a Wall Connector Charger 1011831 00 D For Tesla In 2022 Ev Charger Tesla Tesla Motors

Joe Biden Releases New Ev Charging Plan Protocol

How To Choose The Right Ev Charger For You Forbes Wheels

What Are The Different Levels Of Electric Vehicle Charging Forbes Wheels

Best Level 2 Ev Charger Compare Chargepoint Juice Box Grizzl E Siemens Blink More

How To Choose The Right Ev Charger For You Forbes Wheels

What S In The White House Plan To Expand Electric Car Charging Network Npr